After a turbulent first half of 2025 marked by sharply elevated US tariff uncertainty following President Trump’s sweeping “Liberation Day” trade measures, the global economy is adjusting to a more restrictive trade environment, leaving economists and investors increasingly cautious.

Despite the initial rounds of US trade deals not fully addressing policy uncertainty, commodity prices provide more concrete indicators of underlying global demand, inflationary pressures, and investor sentiment. Historically reliable as real-time barometers, recent commodity price trends are now signalling moderating growth prospects and lower risks of runaway inflation dynamics ahead. Three factors support this position.

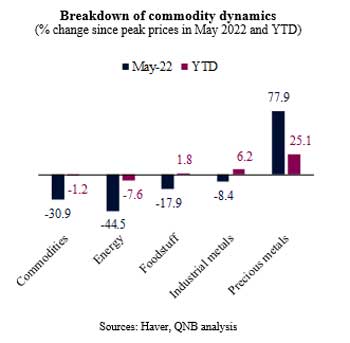

First, the overall performance of commodity indices remains well below their cyclical highs from May 2022, while trading in a relatively tight range since the beginning of 2025. This stabilization challenges both extremes of the macro narrative – neither pointing to untamed nominal growth re-acceleration nor to a more significant slowdown or recession. In fact, the absence of renewed volatility or major price spikes in cyclical commodities (energy and industrial metals) reinforces the ongoing disinflationary trend, despite the sharp depreciation of the USD and the risk of short-term inflation in the US due to the new

tariffs. At the same time, steady year-to-date price levels imply underlying resilience in global demand, especially for construction and industrial activity. Notably, base metals (copper, aluminium, lead, nickel, tin and zinc) have posted some gains this year, reflecting optimism around a growth acceleration in emerging technologies and in Asia, particularly with regards to electric vehicles, AI, and China.

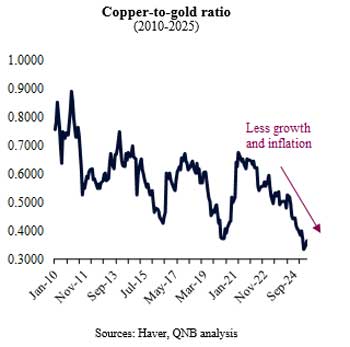

Second, the copper-to-gold ratio – often used as a proxy for market expectations on growth, inflation and risk appetite – continues to drift lower. This contrasts with the scenario in which markets would be pricing in a robust pro-growth, pro-inflation policy agenda under Trump 2.0. In such a case, copper (a growth sensitive asset) would be expected to outperform gold (a defensive hedge), pushing the ratio higher. The current downtrend suggests instead a more conservative stance by investors, consistent with an outlook of moderate slowdown with well-anchored inflation expectations.

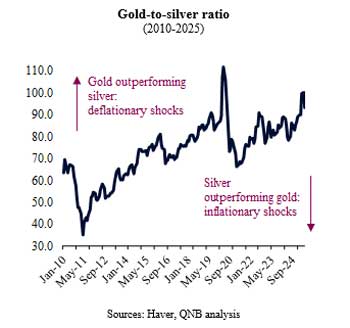

Third, the sustained strength in gold prices appears to reflect heightened geopolitical uncertainty and a flight to jurisdiction-free assets, rather than signals of impeding inflation or overheating demand. Gold is currently trading near record highs – around USD 3,330 per troy ounce – marking close to an 80% increase since the 2022 peak in commodity prices. In contrast, silver, which is both a monetary and industrial metal with key applications in green technology, has been lagging behind until now. However, in recent months, silver prices started to pick up and catch up with the strong performance of gold, suggesting that industrial demand may have bottomed. Were markets expecting a broad-based macro upcycle or runaway inflation, silver would typically lead gold by a significant margin.

All in all, despite policy noise and concerns over the potential inflationary impact of Trump 2.0, the signal from commodity markets remains broadly benign. Most industrial inputs are trading sideways at levels significantly below their 2022 peaks. The declining copper-to-gold ratio and the relative underperformance of silver versus gold reinforce the view that growth should slowdown and inflationary pressures remain contained. In our assessment, the commodity complex is pricing in a soft landing: a glide path of moderate global growth with continues disinflation – a reassuring scenario amid a turbulent political backdrop.